With inflation (from the Latin inflatio “swelling”, derived from inflāre “to swell”) in economics, we indicate the prolonged increase in the general average level of the prices of goods and services over a given period of time, which generates a decrease in the purchasing power of money.

As prices rise, each monetary unit will be able to buy fewer goods and services. Consequently, inflation is also (ceteris paribus, i.e. considering all other conditions unchanged, including income) an erosion of consumers’ purchasing power.

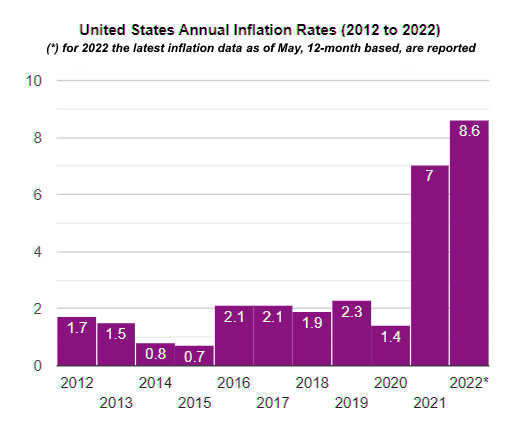

Inflation had been low for years before the last two, as can be seen in the graph below.

What does inflation entail for our investments?

To understand the effect of inflation on investments, one should focus on the “real” return, that is, on the gain adjusted for inflation. Investments that generate a return higher than the inflation rate can protect and possibly increase the future purchasing power of savers.

Suppose that an equity portfolio yields 5% per year and inflation stands at 3%. The real return on the portfolio, i.e. the return minus the inflation rate, would be 2%. The equity investment, therefore, would continue to increase the investor’s purchasing power even if “really” only by 2% per year. Conversely, suppose our equity or other portfolio yields 2%. In this case, inflation would be higher, and in fact, we would erode our purchasing power by 1%, and our standard of living would certainly suffer.

What can we do to protect ourselves?

This is why inflation-linked bonds were designed and created. ILBs are designed to help investors protect themselves from the negative impact of inflation by contractually linking bond principal and interest to a nationally recognized measure of inflation, such as the US Consumer Price Index and the UK Retail Price Index.

Today, inflation-linked bonds are mainly issued by governments in an attempt to reduce financing costs and expand the investor base, and occasionally by companies for the same reason, but still for a relatively low total amount.

What are the returns?

Since an ILB is explicitly linked to a nationally recognized measure of inflation, any increase in the price of goods translates into a direct increase in the value of capital. For example, consider a US 20-year TIPS worth $ 1,000 with a 3% coupon (1.5% semiannual) and an inflation rate of 5%. The capital will increase daily based on the inflation rate. At maturity, the capital value will be $ 2,685 (5% per annum compounded every six months). In addition, even if the coupon remains fixed at 3%, the dollar value of each interest payment will increase as the coupon will be calculated on the value of the capital adjusted for inflation. The first semi-annual coupon of 1.5% paid on an inflation-adjusted principal of $ 1,025 is equal to $ 15.375, while the last semi-annual coupon will be equal to 1.5% of $ 2,685, or $ 40.275.

All ILBs, regardless of the issuer, are designed to offer investors contractually indexed returns to inflation and can serve as a tool to protect yourself from rising prices. Monthly returns from ILBs have historically shown a positive correlation with monthly changes in inflation, while many of the other major asset classes, such as equities, nominal government bonds, and corporate bonds, have little or no correlation with inflation over an extended period.

Every saver and consumer, being exposed to inflation, should evaluate a form of coverage of this risk. As traditional investment classes can suffer from periods of persistent inflation, the use of ILBs as a form of protection allows us to ensure a real return to the portfolio in various market contexts.

Are the returns guaranteed?

If the ILBs are held until maturity, the price fluctuation due to changes in real yields does not really count. Before maturity, however, the market value of the security rises or falls relative to its face value. Thus, ILBs revalue in the market if real yields fall and devalue if real yields rise.

In other words, if, during the life of an ILB, the economy goes through a phase of deflation, that is a prolonged fall in prices, the inflation-adjusted capital can fall below the nominal value. Subsequent coupon payments will then be based on this deflation-weighted value. However, many countries that issue ILBs, such as the USA, Australia, Germany, and France, offer a deflation floor upon maturity. This means that if deflation brings the capital below the nominal value, the investor still receives the nominal value at maturity. Thus, while the coupon payment is based on the capital weighted for inflation or deflation, at maturity the investor receives the highest amount between the capital adjusted for inflation and the initial nominal value.

Are there any other benefits?

Other advantages coming from the inclusion of ILBs in a traditional equity and bond portfolio include greater diversification and lower volatility. In fact, ILBs have historically shown a low correlation with stocks, commodities, and other asset classes, and react differently from them to market changes. Consequently, including them in a portfolio allows the portfolio itself to be more diversified and less volatile, which positively alters the trade-off between risk and return even in cases where the total losses remain the same.

The break-even inflation rate

To compare ILBs and nominal government bonds and determine their relative value, one can compare nominal and real yields, and calculate the break-even inflation rate, that is, a value that indicates the inflation expectations implicit in the market. If the effective inflation rate during the bond’s life is higher than the breakeven rate, investors earn more with ILBs by assuming a lower inflation risk. If the actual inflation rate is below expectations, the nominal bond with the same maturity offers a higher yield, albeit with higher inflation risk.

For example, if a 20-year Canadian government bond yields 3% and a Canadian 20-year real-yield bond yields 0.5%, the breakeven inflation rate is 2.5%. If you think that for the next 20 years Canada will have inflation above 2.5%, you should prefer Canadian real-yield bonds.

Conclusion

Anyone who has savings or consumes goods and services is exposed to inflation and can benefit from an investment in ILBs. Furthermore, ILBs react in a particular way to various economic contexts and therefore represent an essential diversification tool within a broader portfolio and in general, allow to reduce its overall volatility.

[…] there are Inflation-Linked Bonds (ILBs), which we talked about in a recent article, that would protect our investment from high […]