The options offer many possibilities to interact with the movements of the stock market. The combination of bought and/or sold options offers investors the opportunity to convert expectations into an options trading strategy, which can also help limit risk.

Here we discuss the most common options trading strategies.

Options spreads

Before we get into some of the different options strategies, let’s introduce option spreads and three common classifications. An option spread is an options strategy in which you buy and sell an equal amount of options with the same underlying asset, but with different expiration dates and/or strike prices. The following types of options spreads are available according to the relationships between the strike price and expiration dates of the options involved:

- The vertical spread involves the use of options with the same underlying asset and maturity date, but different strike prices.

- The horizontal spread is created using options with the same underlying asset and strike price, but with different expiration dates. It is also referred to as a calendar spread or time spread.

- The diagonal spread is a combination of vertical and horizontal spreads. This strategy is built using options with the same underlying asset but different strike prices and expiration dates.

Options strategies classification

In addition to spreads, options strategies can also be ranked based on the expected direction of the market. Based on the outlook, the strategies are classified as:

- bullish,

- bearish,

- neutral,

- volatile.

Bullish strategies are typically used when the price of the underlying stock is expected to rise.

If the price of the underlying shares is expected to decline, a bearish strategy can be chosen instead.

Also known as non-directional strategies, a diagonal spread should generally be used when the underlying stock is expected to not move at price or to move within a narrow range.

You might choose to use a diagonal spread when you believe the underlying stock will have a large price swing but are unsure of the direction.

Examples of some common options strategies

Below are explanations of some of the more common options strategies used by investors. We include examples of each of them so that you can get a better understanding of these concepts. Please note that the examples and results shown are indicative and exclude transaction costs.

Covered call

With a covered call, you sell a call option when you already own the underlying shares or purchase them. In this case, you receive a premium from the sale of the call, and the short position is “covered” if the buyer of the call chooses to exercise it because you own the underlying shares and are therefore able to deliver them.

Covered calls are considered a neutral strategy as they are typically used when it is assumed that the price of the underlying will not move much in the near future. The maximum profit with this strategy is the premium received from the sale of the call plus the difference between the strike price of the option and the purchase price of the underlying securities. The maximum potential loss is equal to the purchase price of the underlying less the premium received.

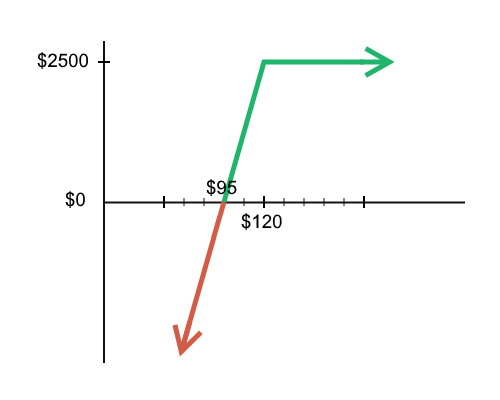

Below is an example of a covered call:

Buy: 100 XYZ shares for $ 100 per share

Sell: 1 XYZ 120 call (out-of-the-money) for $ 5

Net premium = $ 5

If the premium received is $ 5, then the breakeven point is $ 95. If the price of the underlying rises above the break-even point, then a profit is made, with the maximum being $ 2,500 ($ 20 price difference, plus the $ 5 premium received, multiplied by the contract size of 100). Losses, in this case, occur if prices fall below the break-even point. They are offset by the premium received, but theoretically, the losses can be substantial if the price of the underlying falls.

Bull call spread

A bull call spread is a type of vertical spread strategy. As the name suggests, a bull call spread is used when pursuing an upside strategy on the underlying. To exercise this strategy, you buy and sell an equal amount of call options with the same expiration date and the same underlying. The long call should have a lower strike price than the short call.

Both profits and losses are limited with this strategy. Potential profit is the difference between the two strike prices minus the net premium. The potential loss is the net premium.

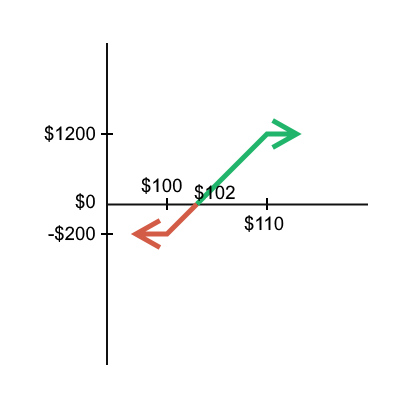

Below is an example of a bull call spread:

Buy: 1 XYZ 100 call for $ 5

Sell: 1 XYZ 110 call for $ 3

Net premium = $ 2 ($ 5 – $ 3)

The premium paid is $ 2, therefore, the break-even point is $ 102 (strike price + net premium). If the price of the underlying rises above $ 102, then you make a profit with a maximum of $ 1200 ($ 10 of price difference, minus the net premium of $ 2, multiplied by the contract size of 100). Losses occur if the price of the underlying falls below the break-even point. In this case, the maximum loss is $ 200.

Bear put spread

The bear put spread is also a type of vertical spread strategy that is typically used when a decline in the price of the underlying asset is expected. This strategy involves buying and selling an equal amount of puts with the same underlying and the same maturity date. The put that is sold should have a lower strike price than the put that is purchased.

The maximum profit with a bear put spread is equal to the difference between the strike prices and the net premium paid. On the other hand, the maximum potential loss is the premium paid.

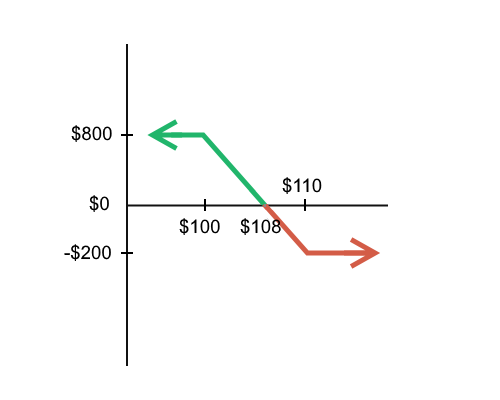

Below is an example of a bear put spread:

Buy: 1 XYZ 100 put for $ 5

Sell: 1 XYZ 110 put for $ 3

Net premium = $ 2 ($ 5 – $ 3)

The net premium paid is $ 2 and therefore the break-even is $ 108. It is earned if the underlying asset falls below the break-even. In this example, the profit is maximized to $ 800 ($ 10 price difference, minus the net premium of $ 2, multiplied by the contract size of 100). If the price of the underlying rises above $ 98, a loss with a maximum of $ 200 occurs.

Long straddle

With this strategy, one profits from significant price movements in both directions and is therefore considered a volatile strategy. When the price remains stable enough, you can lose money. To exercise this strategy, you buy an equal amount of calls and puts that have the same underlying shares, strike price, and expiration date. Strike prices, in this case, are at the money.

There are two break-even points with this strategy, the strike price minus the net premium paid and the strike price plus the net premium paid. The risk of a straddle options strategy is limited to the premium paid. If the price goes up or down, the net asset value of one of the options goes up. This means that the premium paid is (partially) recovered or the investor can also make a profit with this increase. Profits can be unlimited with this bullish strategy.

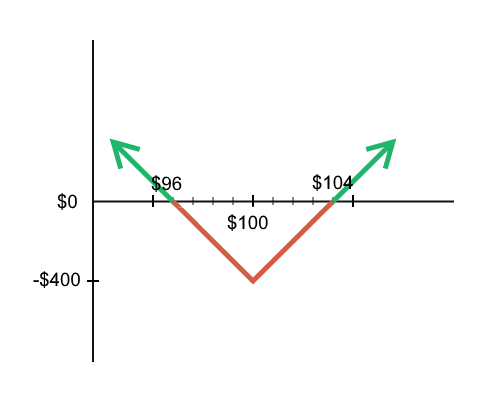

Below is an example of a long straddle:

Buy: 1 XYZ 100 call for $ 3

Buy: 1 XYZ 100 put for $ 1

Net premium = $ 4 ($ 3 + $ 1)

The net premium paid is $ 4, making the breakeven prices $ 96 and $ 104. If the price of the underlying falls below $ 96 or above $ 104, you will make a profit. If the price of the underlying falls between $ 96 and $ 104, there will be a loss. This loss is maximized to $ 400 ($ 4 net premium paid times the contract size of 100).

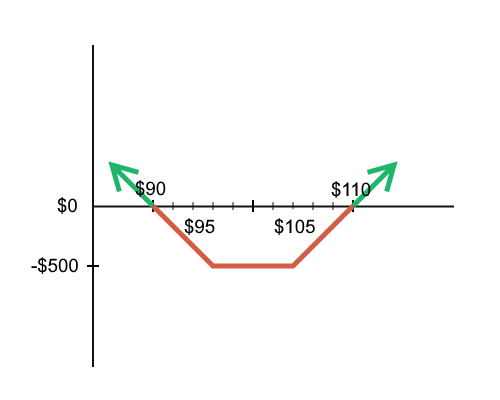

Long strangle

With this options strategy, you benefit from significant price movements. This strategy is similar to the long straddle. The difference is that in this case, the strike prices are not the same. The strike price of the call option is higher than that of the put option and both are out of the money. The underlying asset and the maturity date are the same for both. If the share price at maturity is equal to or between the strike prices, both contracts expire worthlessly.

With a long strangle options strategy, losses occur when the price of the underlying is between the breakeven prices. There are two break-even prices, the highest strike price plus the net premium and the lowest strike price minus the net premium. Potential losses are limited to the premium paid. Profits, on the other hand, have the potential to be unlimited.

Below is an example of a long strangle:

Buy: 1 XYZ 105 call for $ 3

Buy: 1 XYZ 95 put at $ 2

Net premium = $ 5 ($ 3 + $ 2)

The premium paid is $ 5. Therefore, the break-even prices are $ 90 and $ 110. If the price of the underlying falls below $ 90 or above $ 110, you will make a profit. If the price of the underlying falls between $ 90 and $ 110, there will be a loss. This loss is maximized to $ 500 ($ 5 premium paid times the contract size of 100).

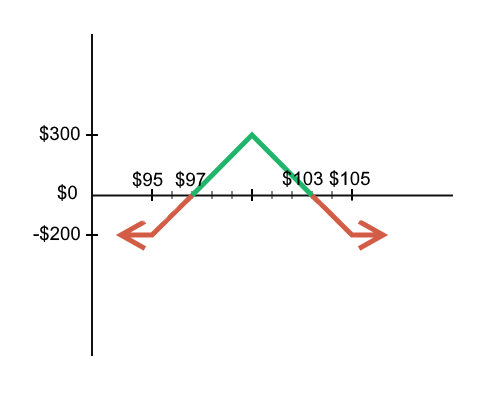

Butterfly spread

This butterfly options strategy is a combination of two vertical spreads and is considered a neutral strategy. This is a three-part strategy where you buy one option, sell two options with a higher strike price, and buy one option with an even higher strike price. They all have the same underlying asset and maturity date and the strike prices are equidistant. It takes its name from the shape of the chart that is created with the combination of options contracts.

The maximum potential profit and loss are limited. The maximum losses are limited to the net premium paid. Losses occur when the price of the underlying asset falls below the lowest strike price or above the highest strike price. The maximum potential profit is equal to the difference between the average strike price and the lowest strike price, minus the net premium paid. The maximum profit is realized when the underlying asset reaches the strike price of the short calls.

Below is an example of a long call butterfly spread:

Buy: 1 XYZ 95 call (in-the-money) for $ 5

Sell: 2 XYZ 100 calls (at-the-money) for $ 2 each

Buy: 1 XYZ 105 call (out-of-the-money) for $ 1

Net premium = $ 2 ($ 5 + $ 1 – (2 x $ 2))

The net premium paid is $ 2. Consequently, the break-even prices are $ 97 and $ 103 (lowest strike price plus net premium and highest strike price minus net premium). If the price of the underlying is between $ 97 and $ 103, you make a profit. This profit is capped at $ 300 (average strike price of $ 100, minus the lowest strike price of $ 95, minus the net premium of $ 2, multiplied by the contract size of 100). If the price of the underlying asset falls below $ 97 or rises above $ 103, a loss will occur. This loss is maximized at $ 200.

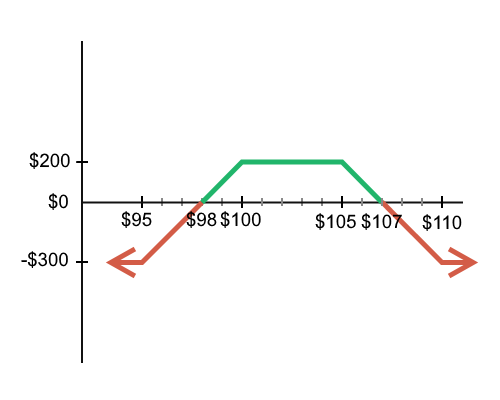

Iron condor spread

A condor spread long is a four-part strategy and is similar to a butterfly spread in that it also uses two vertical spreads and is considered a neutral strategy. The four options involved have the same maturity date and the same underlying asset, but all have different strike prices.

To build it, you buy a put, sell a put with a higher strike price than the purchased put, sell a call with a higher strike price than sold, and buy a call with the highest strike price of all. the options involved. The call spread and the put spread are of equal width.

Potential profits and losses are limited. If the price of the underlying asset is between the breakeven points, you get a profit that is maximized by the net premium received. Compared to a butterfly spread, there are more outright prices where you can get the most profit. If the price of the underlying asset is outside the above range, a loss occurs. The maximum possible loss is equal to the difference in the strike prices of both spreads, less the net premium received.

Below is an example of an iron condor:

Buy: 1 XYZ 95 put (out-of-the-money) at $ 1.50

Sell: 1 XYZ 100 put (at-the-money) at $ 2

Sell: 1 XYZ 105 call (at-the-money) at $ 2.50

Buy: 1 XYZ 110 call (out-of-the-money) for $ 1

Net premium = $ 2 (- ($ 1.50 + 1) + ($ 2 + $ 2.50))

The net premium is $ 2. Consequently, the break-even prices are $ 98 and $ 107 (short put strike price minus net premium and short call strike price plus net premium). If the price of the underlying asset is between $ 98 and $ 107, you make a profit. This profit is limited to $ 200. If the price of the underlying asset stays below $ 98 or above $ 107, a loss will occur. This loss is maximized to $ 300 ($ 5 in the difference between strike prices, minus the $ 2 premium received, multiplied by the contract size of 100).

What are the risks involved in investing in options?

Before investing in options, it is important that you first learn what the options are, but above all, that you understand the risks. Options and other complex products are not intended for novice investors, and some strategies are more advanced than others.

Although some of the strategies mentioned are intended to limit risk, if the strategy is not carried out correctly, you run the risk of losing your entire investment or more. You should only invest in products that match your knowledge and experience and are suitable for your investment plan.